How to tell if you are late to bitcoin, and how much of it you may want

I f you wish you had taken bitcoin seriously earlier on, you’re not alone. So do I, and so does every bitcoin enthusiast I’ve ever talked to. What else could you expect? The value of a bitcoin has skyrocketed relentlessly for 15 years, but only a small handful of people were even aware of bitcoin’s existence near the beginning of its epic ascent. Everyone else entered later, and has had to endure looking back at lower prices. Every bitcoin holder you’ll meet has at one time thought “I wish I had bought bitcoin earlier, before it went up in value so much.”

Among those who were lucky enough to take notice of bitcoin during its first few years, even fewer predicted what it would become. People who bought any were very likely to sell it shortly afterward, as it became tempting to “take profit.”

A Twitter lamentation from 2011, when a bitcoin cost $8.

In 2011, there were people perceived themselves as latecomers who had missed out. There were people with the same perception in 2012, 2013, 2014, and every calendar year since then, to the present year 2025. It’s a tradition at this point.

So, welcome to the club! You’re in great company. We all feel like latecomers to bitcoin. Let us all sigh together, and daydream about what could have been. Alas, it’s not our reality, so let’s move on.

Those “latecomers” were actually early… are you?

The issue with telling someone that they are “still early” to an investment that has already gone up in value a lot, is that it resembles a common ploy from scammers. Thousands of pump-and-dump schemes (especially cryptocurrencies) have used this verbiage to entice victims, convincing them that they will strike it rich like the people who got in before them. Then, these victims wind up “holding the bag” and taking a loss.

When someone tells you that you should get onboard with an investment you don’t understand very well, because it’s shooting up in price but you’re still early, it’s wise to be skeptical. If you don’t know the person very well, they might be trying to scam you directly. If the person is a friend or family member, you might be wary that they have fallen into someone else’s trap, and want to avoid joining them.

However, despite these concerns, it’s clearly not impossible to be “still early” on an investment that has already been performing very well. Occasionally, winners are able to continue winning for decades on end. Take for example, stock in Apple or Microsoft.

So, how can you tell if you really are “still early” to something that will continue to win, or if you’re potentially buying at the mountain top, with nowhere higher to climb?

Don’t buy into things you don’t understand

A good way to protect yourself is to avoid putting much money into an investment you don’t understand. However, this is no excuse for laziness. If you don’t understand bitcoin, your reaction shouldn’t be to avoid it, but instead to learn about it! You’re already reading this article, so that’s a great start. I also have carefully crafted a resources page for you.

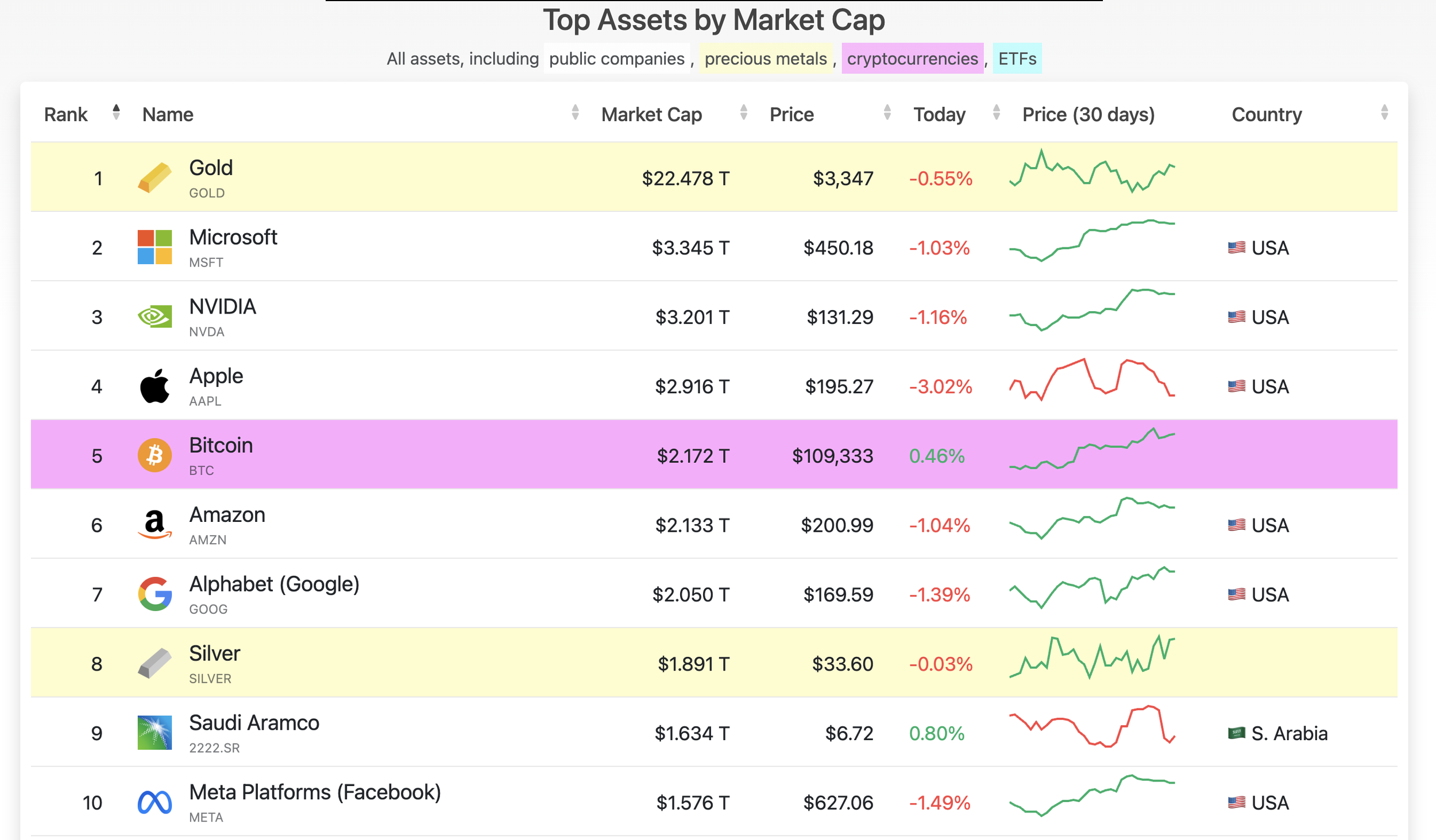

I can empathize with the hesitation to spend time and effort learning something new. After all, it’s an impossible commitment to learn about all the new technologies that are out there, or all the different investments you might be presented with. I must point out, however, that bitcoin has become so significant that ignoring it is no longer rational. It is now the fifth largest asset in the world, larger than silver, Google, and Amazon. That should suggest to you it’s not a fluke, or a waste of time to study.

I actually consider learning about bitcoin to be far more important than buying it. This is the recommendation that I prioritize when speaking to newcomers. After all, once someone learns about bitcoin, wanting to buy it will come naturally.

The reverse is not true. Someone could buy a lot of bitcoin, but not understand it very well, in which case they are susceptible to getting rid of it prematurely and emotionally. If there is no understanding and conviction behind an investment, then a temporary price drawdown will likely lead to panic selling at the worst possible time, while those who understand bitcoin will be opportunistically buying more.

How high can bitcoin go?

When it comes to investments, there are two main approaches to take. One approach is to buy in, hope the price goes up, and then sell it for a profit. This is known as trading, and the end goal is getting more dollars. The other approach is a bit different—it’s built on the recognition that having dollars is problematic. Dollars are not a very desirable way to store wealth, because their value declines over time from inflation. Therefore, people using this approach might buy the S&P index, or real estate, or gold, or whatever else, not because they have the mindset of a trader, but because they need a default method of storing wealth outside of dollars. In other words, they are buying not because they want more dollars, but because they want less dollars. They have no intention of selling at any particular price to “take a profit.” They intend to continue holding the superior asset indefinitely, or until they might want to purchase something else.

This second approach is the best way to view bitcoin. Bitcoin is a long-term savings tool, a scarce asset without inflation. It represents the healthiest form of money you can hold across lengths of time, and it’s superior to the depreciating dollar in this regard.

The price of a bitcoin has no ceiling, because the value of a dollar has no floor.

When the marketplace offered $10,000 for a bitcoin, people faced the question of which tool they’d prefer to use to store that amount of wealth. Ten thousand dollars? Or one bitcoin? Bitcoin, being a superior form of money, was the better answer. Now the marketplace is offering $100,000 for a bitcoin, and people face the same question of which tool to use to store their wealth, but the best answer hasn’t changed. Nor will the best answer change if the marketplace offers $1M or $10M or $100M, and so on.

Therefore, there is no price at which bitcoin is “too expensive.” There is no price at which it’s rational to trade bitcoin for dollars merely for the sake of “taking profit.” If you do, you’ll be left with a bunch of dollars melting in value, and to protect your wealth you’d have to trade them away to acquire a better asset, such rebuying the bitcoin you just sold.

(Note that if you need short-term savings, for upcoming purchases with merchants that only accept dollars, then it could make sense to hold dollars for that brief period of time. It’s in the context of long-term savings that bitcoin is the obvious choice. For any period longer than 3 years, holding bitcoin has performed better than holding dollars, which is best visualized in the Hodl Cave charts.)

The bagholders are the people with dollars

Buying bitcoin represents upgrading your money, and selling bitcoin represents downgrading your money. This understanding is spreading, and people have begun rushing to convert their dollars into bitcoin, especially before other people catch on. The people who will be “left holding the bag” are those who continue to hold dollars and refuse to upgrade.

The value of a dollar has plummeted 91% in the last 5 years, and 99% in the last 10 years, when measured in bitcoin. If you hold dollars, this should worry you, but if you hold bitcoin, you can sleep soundly at night.

Is it even possible to be late to bitcoin?

When people think of what it means to be “late” to an investment, they might imagine that “the gains have already been had, and there is no more for me.” As we just covered, this can’t be true in the context of bitcoin and dollars. Trading dollars for bitcoin always represents a good decision from a long-term savings perspective. There is no point at which someone wouldn’t benefit from upgrading their money. So in this sense, you’re never late enough to throw up your hands and say “well, I guess I missed the boat.” The wise course of action is to humbly buy bitcoin at a higher price, as all bitcoin holders have had to do. Don’t let psychological hurdles obstruct your rationality.

But there is another metric we can use to determine “lateness.” The price of bitcoin and the purchasing power of bitcoin are two different things. The price of bitcoin represents how many dollars one bitcoin will get you. The purchasing power of bitcoin is how many real goods and services one bitcoin will get you. We know these measurements are different, because dollars tend to go down in value compared to goods and services (the dollar prices of goods and services rise due to inflation).

The price of a bitcoin will go up forever, just like the price of a house or a gallon of gas will go up forever. So the real question is: how much more can we expect bitcoin’s purchasing power to rise? Has the most of this already occurred, implying you are “late” and would be no better off buying bitcoin than buying a gallon of gas?

Assessing bitcoin adoption

To get an idea of how much further a bitcoin can rise in purchasing power, there are some fairly simple methods we can use. Bitcoin has a fixed supply of 21 million coins, so its value (purchasing power) depends not on the supply, but on people’s demand for it. Among the people who have a good understanding of bitcoin, demand is already quite high, and doesn’t have much room for growth. Among those who don’t understand bitcoin well at all, demand is basically zero. We can expect that the people who don’t understand bitcoin will eventually learn about it, and once they learn about it, they will demand it. Therefore, the remaining demand for bitcoin (and thus the remaining room for growth in purchasing power) is a function of how much capital there is in the world held by people who don’t yet understand bitcoin.

Upon realizing this, and subsequently remembering that pretty much none of your friends or family understand bitcoin, it becomes quite obvious that you are not late to bitcoin. You are, in fact, still very early. However, if you refuse to adopt bitcoin even as you see the people in your life doing so, you will risk being “late,” in the sense that there will be less future purchasing power growth to take advantage of.

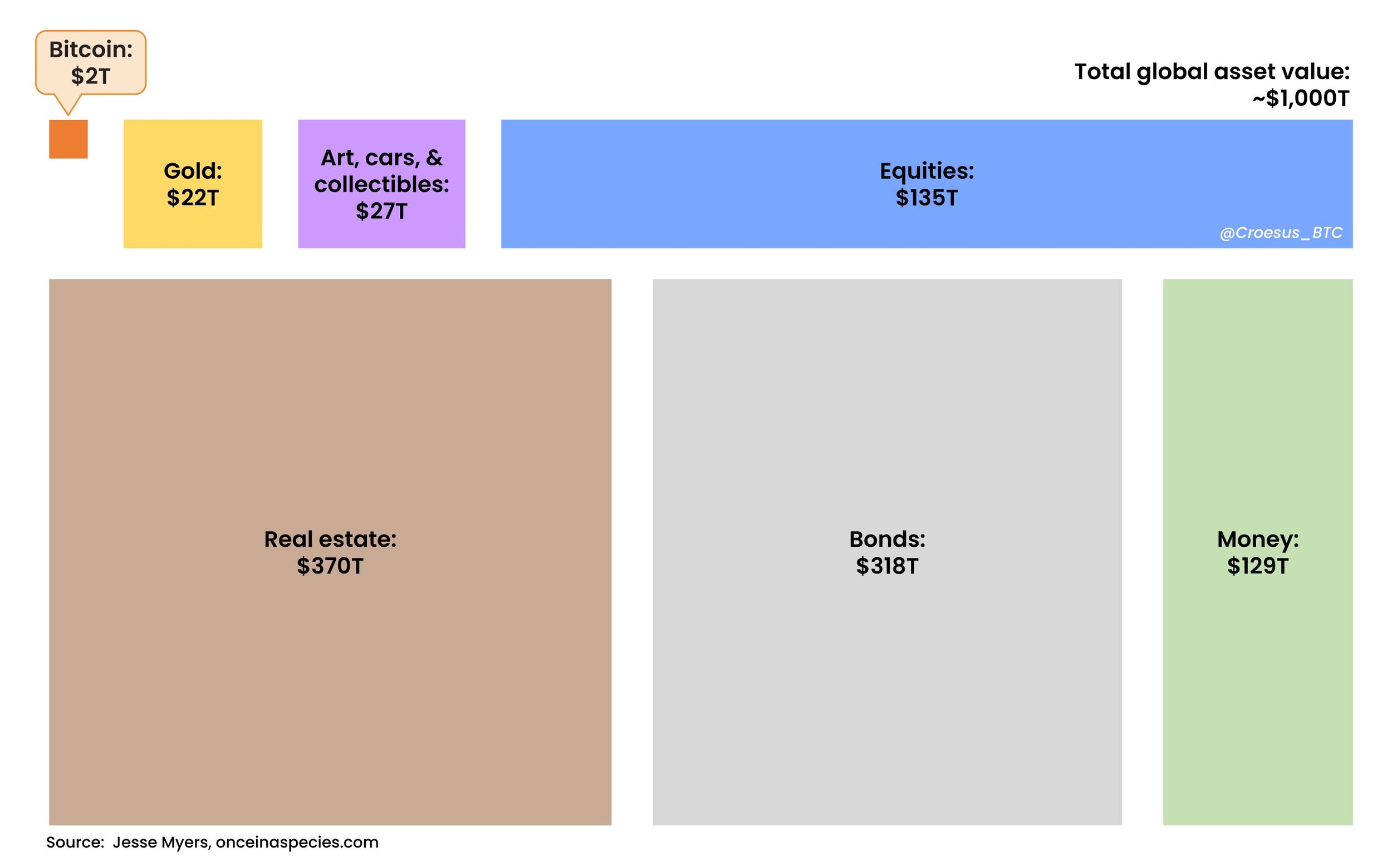

Besides thinking about the lack of bitcoin knowledge among your peers immediately around you, you can also observe the raw numbers of how much wealth is currently being stored in inferior assets like government currencies, bonds, and gold. There is a lot of room to fill:

How much bitcoin should you aim for? How much is enough?

Bitcoin is money. How much money is “enough” for you is dependent on your personal views. For some people the answer is always “more.” But let’s suppose that you just want your “fair share” of the bitcoin. This can be calculated without much effort.

There will only ever be a maximum of 21 million bitcoin, and some of it is already lost forever. There are more than 8 billion people on Earth. As we can see from this lovely website that tracks the math, there are only about 0.0025 bitcoin per person. If we keep things simple, this is your fair share.

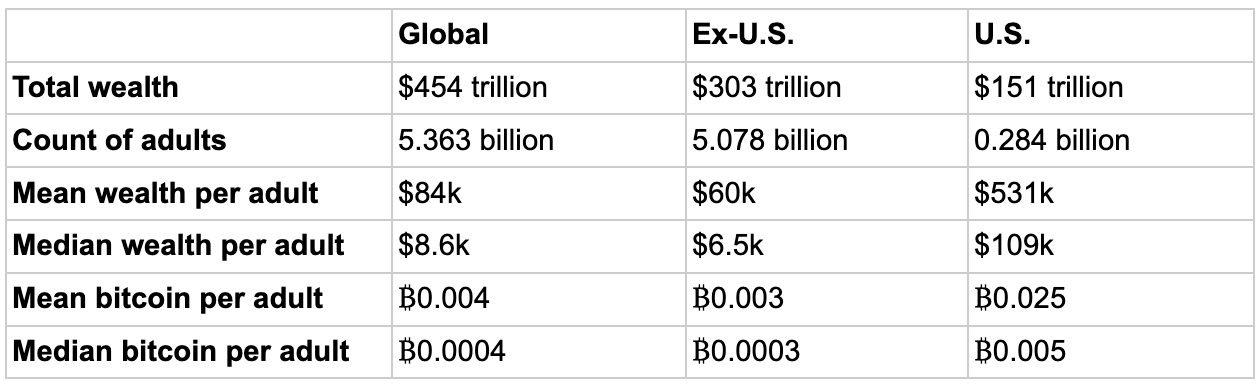

But we can be a bit more precise. By excluding children and focusing on adults, and accounting for the relative wealth of adults in different regions, we can arrive at more personalized numbers.

I used AI to cross-reference data from several sources, and was able to find some approximate data about the current global wealth distribution, as well as the wealth distribution outside and inside of America (given that most people reading this will likely be American).

Data is from around 2022-2025.

The data suggests that if you are representative of the median American adult, and have wealth amounting to around $109k, then to maintain your lifestyle and relative socioeconomic status in a world dominated by bitcoin, you would need to get yourself about 0.005 bitcoin. If you are in a American household of two adults and together you possess the median wealth of around $218k, then you would need about 0.01 bitcoin.

By maintaining the proportions, you can calculate a personalized minimum bitcoin target based on your current wealth. Simply take your wealth measured in 2025 dollars, and divide by 21,800,000 to figure out how much bitcoin you might consider acquiring.

Upon full global adoption, the implied purchasing power of 1 bitcoin would be about the same as the purchasing power of $22M in today’s world. Given that a bitcoin currently costs about $100k, this serves as more concrete evidence that you are indeed “still early” if you are buying bitcoin. The purchasing power of bitcoin can still rise by around 220x.

“It might make sense just to get some in case it catches on.”