The retrofuturistic renaissance: A return to quality, beauty, and virtue

W hy is it, that despite immense technological advancement over recent decades, the developed Western world has simultaneously experienced such a terrible decline?

Perhaps there is some controversy within the premise of the question. Some may argue that “we live in the best period of human history,” citing access to food, information, tools, and medical care. There have been increases to longevity and overall protection from the perils of nature. If this aligns with your perspective, I must push back, and remind you to look around you.

Despite improvements to the ability to stay alive, what kind of life is it? In the developed West, its quality has deteriorated considerably across many measures. Diminishing health (physical, mental, social, and financial) is apparent. Society is sick, dissatisfied, and pessimistic. The environment we’ve built for ourselves has become fake and ugly. Older generations recognize it as they reminisce about the wholesome good ol’ days. Younger generations recognize it with angry confusion, as they watch historical videos of genuinely happy, wholesome people from a foreign world that existed beneath their feet just a few decades prior.

If you’re unconvinced, I believe I can better illustrate this point later on in this article, by examining developments in aesthetics, culture, and technology. Returning to the original inquiry and the reason behind the societal decline, I believe our answer lies within human values. To elaborate, I want to offer you a specific approach for exploring our values, how they have changed, and why. Finally, I will present an optimistic prediction about a coming renaissance, and the driving force behind it.

The language of value

Values describe what we consider to be important to us. They explain how we prioritize one desire over another. In the marketplace of goods and services, the language of value is typically money. What an individual will buy with their money reveals what they desire and consider a bargain, while what an individual refuses to buy reveals what they don’t desire, or consider too expensive (in other words, what the individual values less than their money and other things their money might buy).

Merchants try to assign prices that best match the average consumer’s values—if prices are set too low, there will be too many customers and the store will be cleaned out with a missed opportunity for profit. If prices are set too high, there will be very few customers. If a product is being offered that nobody wants at the current price, and the cost to produce it prohibits lowering the price, then its production will eventually cease.

This may seem quite elementary. But what might be less obvious is that consumers are actually engaging in a comparison of values. They are comparing how they value a good or service with how they value the money they hold. The money is half the equation! That means the particular tool being used as money and the details surrounding it are of crucial importance to marketplace behavior. The desirability of the money itself necessarily impacts how consumers shop, what goods and services merchants choose to offer, and what businesses succeed or fail.

If a good form of money is being used which people value highly, they will be less eager to part with it. They will make more decisions to save rather than spend, or they will demand higher quality products to inspire a trade. On the other hand, if a bad form of money is being used which people don’t value as highly, they will be more eager to part with it. There will be less saving and more spending, potentially even when the quality of products is lower. Businesses with poor service, shoddy craftsmanship, and dishonest practices would be more likely to survive.

What are the key features of a money which make it good and desirable, versus bad and undesirable? There are a number of things which could make an item an impractical monetary tool, but most of these things prevent the item from ever being used as money in the first place. We don’t use tree leaves as money, or boulders as money, for reasons you could likely deduce on your own (although if you are interested in exploring this concept I will refer you to a video I made). Among the tools humans have actually used as money, a primary factor determining their desirability is how well the money preserves value, or purchasing power. If the money holds value across time, it is conducive to saving, while if the money deteriorates in value across time, its owner is incentivized to spend it sooner rather than later.

Let’s use this framework to examine a few forms of money and how they would be expected to affect consumer demands in the market, shaping what society has to offer.

The good: our golden history

For much of human history, people have gravitated toward gold as a monetary tool. Gold is a relatively rare yet recognizable substance that doesn’t decay. It’s proved difficult to locate and extract new pieces of gold, which would increase the total supply and dilute the value of the existing gold. Because of these unique properties, gold has been a desirable form of money. In a society using gold as money, it created confidence that the value people earned could be saved for the future, rather than needing it to spend it on short notice to get the most value in return.

Naturally, this leads to less financial uncertainty. People opt to build savings so that they are better prepared for unexpected emergencies, rather than having little or no savings and needing to stress about reacting quickly to the possibilities of what the future holds. Reliable savings allows society to better plan for the future, lowers time preference, and shifts attention toward projects that could take years, decades, a lifetime, or more.

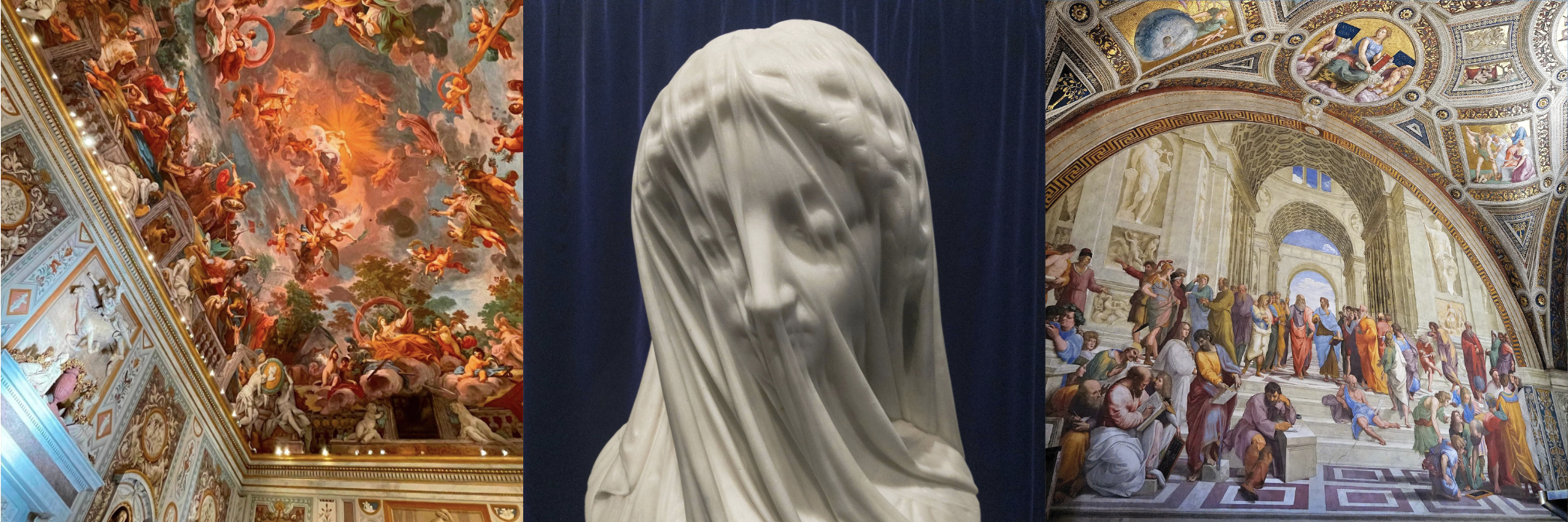

When designers, builders, artists and other creators possess the financial reliability to plan further into the future, it loosens their restrictions. There can be more attention to detail and beauty. Rather than rushing a project, a creator can put their best effort into it, and maximize their sense of pride and accomplishment upon completion. Creations can be made with meticulous passion, causing others to stand in awe of what humanity is capable of. The final products can inspire others to compete and push the bounds of creativity. The result is a society of heightened morale, optimism, virtue, and one that is celebratory towards human life. The quality can be seen, felt, and heard:

Detailed perfection in art

Ornate symmetry in architecture

Solid craftsmanship in decor

Classy, wholesome talent in music

Unique styling and practical simplicity in vehicles

The bad: our fiat situation

Unfortunately, gold is inconvenient to transport and transact with. This critical deficiency has pushed economies toward derivatives like paper certificates, redeemable for gold held by a custodian, and easier to deal with day to day. However, as we’ve seen time and time again, these custodians eventually abuse their privileged position by issuing extra certificates beyond the gold held in reserves (most often, the custodian is a state, and the state is engaged in warfare it feels it cannot afford to lose). This chain of events is how we end up with fiat money.

Fiat means “by decree.” It is money by government law, such as dollars or euros, and it is also the dominant form of money in the world today. The supply of a fiat money is determined by the whims of the state (or central banks pretending to be separated from the state), and they can decide how much money they’d like to create out of thin air at any time. Such an ability is frequently exercised, to generate a seigniorage profit. However, introducing new units of money causes all existing units to be diluted and lose value. This describes the well-known phenomenon of inflation, where the prices of most goods and services rise over time (or, more accurately, the purchasing power of the money declines over time).

A money that deteriorates in value is less desirable to hold onto, and disincentivizes saving for the future. People who want to get the most out of the money they’ve earned must spend it as soon as possible. It follows that society using this type of money will be more focussed on the present than the future, meaning they will have a higher time preference. Members of such a society will tend to prioritize instant gratification over long-term fulfillment. They will be less prepared for emergencies, and will therefore deal with increased uncertainty and stress.

In a world of fiat money, the impatience with which consumers must buy things and merchants must sell things to simply maintain a standard of living, leaves little room for long term projects. Beauty and attention to detail suffers. Design quality and product longevity suffers. Pride in one’s work suffers, because the worker knows she is capable of things much greater than what she is paid to do. The result is a society of low morale, pessimism, even nihilism, and it negatively affects every facet of our lives. This idea could be explored in endless detail, beginning with books such as The Fiat Standard by Saifedean Ammous, Fiat Ruins Everything by Jimmy Song, and Fiat Food by Matthew Lysiak.

Once you understand this concept, the modern world you observe each day finally starts to add up. The effects of fiat money become obvious, everywhere around you. With less time to pay attention to detail and beauty, the ornate has fallen out of style, and minimalism dominates. Poor quality, fake materials, bland colors and plain geometry appear everywhere. Contemporary culture has even started to become attracted to such aesthetics, as fine detail and complexity starts to feel confusing, overwhelming, and out of place.

Soulless architecture, where shifts in plain colors and protrusions are the only sources of interest

Beige and stainless steel decor, designed to mute the mind

Vehicles all have the same basic curvy shape and brands can barely be distinguished

Modern and contemporary art, need I say more?

Even affluence lacks imagination, coveting exaggerated versions of the same styles

The ugly: a counterculture of entertainment tech and crypto

Children born into a society of hyper-minimalism are not positioned to find it natural. Their developing brains are built to explore their environment and learn about the intricacies of the world. They require stimulation and inspiration, which can be difficult to find in the modernist environment described in the previous section. So where is the escape hatch, to fill these needs? Enter the technological entertainment industry.

As it turns out, colorful OLED screens are able to provide people with a stark contrast to the bland minimalist society we find ourselves in. Without expending much real world effort or resources, lines of computer code can generate fake—yet vibrant—worlds to display in movies, video games, and virtual reality. The internet offers infinite access to desirable imagery, meaningless digital challenges, rapid fire sounds and haptics, humor and other emotional content, creating an outlet for the youth (and many adults) to simulate their needs being met. Entertainers have realized that the crazier they behave, and the flashier content they broadcast, the more they can attract these eyeballs hunting for exhilaration.

While this counterculture combats the issue of minimalist simplicity, it has failed to address the problems of nihilism and high time preference—it has exacerbated them. With everyone having easy access to a quick fix of dopamine in the digital realm, the outside modernist world looks even more plain than it already is. A growing number of people find themselves hating life, begrudgingly going to school or work and pretending to engage, but secretly looking toward the next opportunity for a technological distraction. It should be no surprise that depression, anxiety, ADHD and other psychological issues have skyrocketed.

Crypto is not widely adopted as money, but it provides us with the monetary analogy to this world of indulgent entertainment tech. Attempts at creating money are no longer limited to central banks, and anyone with just a little effort can produce their own cryptocurrency out of thin air. They can then begin marketing it to others using colorful bells and whistles, with the hope of generating a seigniorage profit. These flimsy crypto-tokens can be easily manipulated to cause massive spikes and crashes in price, providing yet another opportunity for the excitement and chaos many feel drawn to while trying to escape the modern world.

Technological tools present minimalism externally, but complex stimulation internally

Video games, social media, and movies present increasing levels of colorful, rapid-fire excitement

Trendy music stars have become absurd and degenerate, with lyrics promoting nihilistic behavior

NFTs, meme stocks, and “crypto” are natural beneficiaries of the desperation for fast money and excitement

Day-trading, sensory overloading, and gambling are further examples of instant gratification culture

The great bitcoin renaissance

Luckily, we now have a more promising monetary instrument than humanity has ever had before. Facing the rapidly approaching demise of developed Western society, we caught a lucky break, one that can bring us great optimism.

“With fiat, only central bankers can print money. With crypto, everyone can print money. With bitcoin, no one can print money.” - Phil Geiger

The most desirable money imaginable, the form of money which people are most likely to want to hold and save rather than trade away quickly, is one where there is no slippage in value across time whatsoever. No possibility for the introduction of new monetary units that dilute the existing units held by savers. In other words, a fixed supply. Such a thing has never been available, until the year 2009. While gold was reliably resistant to high levels of inflation, more gold could always still be discovered, extracted, and introduced to the market. And as we covered earlier, gold’s cumbersome nature has always led to a pivot towards alternatives such as fiat money.

Attempting to solve these problems forces one down some necessary paths. The physical realm must be abandoned, because humanity is not equipped to understand the supply of elements within our universe, let alone our solar system, let alone our planet. Instead, a fixed supply can only be a conceptual number, conceived by the human mind. Once the number is conceived, it follows that a ledger is needed to account for all of the units. The ledger must also establish credibility, by being publicly visible and verifiable to anyone, even across transactional updates. It must also possess a mechanism protecting itself from any group wishing to change the supply, steal units, or adjust other fundamental rules. The result looks like a decentralized digital network, which simultaneously solves gold’s convenience problem, because the global transfer of units can occur quickly for a cheap cost.

The human mind that conceived the number and applied it to this framework, was that of Satoshi Nakamoto. The genesis block of the bitcoin blockchain represents the Big Bang of a completely new era for humanity. Credible digital scarcity had finally been engineered, something that can only occur once.

“I think you get to play God once. Satoshi played God. I think the rest of us ought to have the humility to say, we’re not Satoshi.” - Michael Saylor

Attempts to subsequently create alternative cryptocurrencies can only be described as attempts to circumvent the fixed supply of bitcoin, or as attempts to challenge bitcoin’s ledger as being truly credible. Yet, since no other cryptocurrency has ever come close to possessing the number of participants running nodes as the bitcoin network, none have come close to achieving the same levels of decentralization. Without as much decentralization, the scarcity of those alternatives is less credible than bitcoin, not more credible, and their purpose can only be rationalized one way. They are the tools of grifters seeking seigniorage profits, by selling a narrative to gullible victims that their new form of money will be able to repeat the wealth transfer that bitcoin has achieved and will continue to achieve.

Once this is understood, it becomes clear that bitcoin and “crypto” are not the same, nor even as closely related as many assume. They are essentially opposites.

So what are the expected effects of bitcoin’s existence upon society and culture? Now that we have a form of money with a fixed supply and no inherent incentive to abandon it for fiat alternatives, what happens next?

A reasonable conclusion is that as bitcoin adoption grows, our time preference will be lowered to a level that we have never before been able to witness. Low quality minimalist products will begin to dissipate, as people will be less inclined to part with their pristine bitcoin savings to purchase such garbage. Instead, demand will shift toward projects of high integrity, ornate beauty, and meticulous attention to detail. Cities will once again inspire pride in humanity, raising the morale and psychology of their constituents.

During the age of golden money, humans had the confidence to embark on large-scale projects expected to take a century or longer to build. Despite inferior technology, we were able to build cathedrals that are still widely considered wondrous to this day. The men who laid the foundations of these structures did not expect to be alive for the project’s completion. Compare this to today, where I can find no evidence of any new large-scale projects expected to take longer than two decades. Our high time preference has crippled us, offset only by our technology, which has allowed us to erect the tallest buildings in the world, each in just a few quick years.

But these gargantuan walls of glass are far from representing the capabilities of our species. Imagine what we could accomplish if we combined our modern technology with the confidence to use it for long-term endeavors, where every material and intricate detail is designed to showcase the best of humanity—or honor God, if you prefer. It can barely be fathomed; the potential for magnificence is orders of magnitude beyond anything we’ve ever laid eyes upon. This is what I believe bitcoin enables, from massive buildings all the way down to everyday appliances for the average person. The retrofuturistic renaissance is upon us.

There is a good reason I’m not including much imagery in this final section of my article. The beauty and excellence that lies ahead does not yet exist. I am not qualified to present it to you, because one man’s imagination is incapable of demonstrating the best that humanity has to offer. Nor can such a thing be encapsulated within a prompt provided to artificial intelligence to generate imagery. To consider this possible would be arrogant beyond measure. Instead, we can only look to the beauty of our past for inspiration, and eagerly look forward to what is coming—or participate in building it yourself!

The image headlining this article pays homage to the La Sagrada Família cathedral in Barcelona. Construction began in 1882 and initially had no expected completion date, although it is now projected to be finished in the year 2026. When the architect was asked if he was concerned about the length of time it would take to build, he answered, referencing God:

“My client is not in a hurry.”